Difference between revisions of "Economic: Amari"

Allen.brian (talk | contribs) m |

|||

| (19 intermediate revisions by 6 users not shown) | |||

| Line 1: | Line 1: | ||

| − | <div style="font-size:0.9em; color:#333;margin-bottom:25px;"> | + | <div style="font-size:0.9em; color:#333;margin-bottom:25px;" id="mw-breadcrumbs"> |

[[Africa|DATE Africa]] > [[Amari]] > '''{{PAGENAME}}''' ←You are here | [[Africa|DATE Africa]] > [[Amari]] > '''{{PAGENAME}}''' ←You are here | ||

</div> | </div> | ||

| Line 7: | Line 7: | ||

==Key Points== | ==Key Points== | ||

| − | *Ongoing oil and gas exploration in and around Lake | + | *Ongoing oil and gas exploration in and around Lake Albert and the Indian Ocean has proved lucrative. |

| − | *Like other countries in the region, Amari is blessed with abundant natural resources. Amari enjoys the added advantage of greater economic development and a more advanced infrastructure. | + | *Like other countries in the region, Amari is blessed with abundant natural resources. Amari enjoys the added advantage of greater economic development and a more advanced infrastructure than its neighbors. |

| − | *Amari is the economic, financial, and transport hub of East Africa, although agriculture remains the backbone of | + | *Amari is the economic, financial, and transport hub of East Africa, although agriculture remains the backbone of its economy. |

| − | *Ziwa, and to a lesser extent Kujenga, are Amari’s main regional economic competitors. Although these three countries compete for regional economic superiority, they have demonstrated a capability to cooperate to accomplish goals shared in the common interest. | + | *Ziwa, and to a lesser extent Kujenga, are Amari’s main regional economic competitors. Although these three countries compete for regional economic superiority, they have demonstrated a capability to cooperate to accomplish goals shared in the common interest such as security and eco-tourism. |

*Economists generally consider Amari as East Africa’s economic hegemon. | *Economists generally consider Amari as East Africa’s economic hegemon. | ||

*Although governmental regulation and excessive bureaucracy have adversely impacted the economy in the past, recently enacted reforms designed are attracting entrepreneurs and more foreign investors. The government sees itself as an honest broker in ensuring that the marketplace operates fairly, and in the interests of the nation at large. | *Although governmental regulation and excessive bureaucracy have adversely impacted the economy in the past, recently enacted reforms designed are attracting entrepreneurs and more foreign investors. The government sees itself as an honest broker in ensuring that the marketplace operates fairly, and in the interests of the nation at large. | ||

| − | |||

| − | |||

*Corruption and collusion between economic oligarchs and government officials create a drag on economic progress. | *Corruption and collusion between economic oligarchs and government officials create a drag on economic progress. | ||

*Over the past 18 months the government was forced to take over a handful of undercapitalized banks and enact measures to limit the amount of interest banks can charge on loans. These measures caused a temporary shrinkage of credit availability in Amari. Since that time, the economy has rebounded at a moderate pace. | *Over the past 18 months the government was forced to take over a handful of undercapitalized banks and enact measures to limit the amount of interest banks can charge on loans. These measures caused a temporary shrinkage of credit availability in Amari. Since that time, the economy has rebounded at a moderate pace. | ||

| − | |||

*Amari has a robust export economy. Exports include tea, cashews, coffee, cut flowers, sisal, cotton, and Pyrethrum. Amari relies on imports for machinery and transportation equipment, motor vehicles, refined petroleum products, resins and plastics. Despite the large agricultural economy, the country does not grow enough cereal grains to feed its population. | *Amari has a robust export economy. Exports include tea, cashews, coffee, cut flowers, sisal, cotton, and Pyrethrum. Amari relies on imports for machinery and transportation equipment, motor vehicles, refined petroleum products, resins and plastics. Despite the large agricultural economy, the country does not grow enough cereal grains to feed its population. | ||

*Several successive political regimes relied on international and financial institutions to underwrite national economic growth and development investments. An Olvanese company recently completed construction of a new standard gauge railway connecting Mombasa and Nairobi. | *Several successive political regimes relied on international and financial institutions to underwrite national economic growth and development investments. An Olvanese company recently completed construction of a new standard gauge railway connecting Mombasa and Nairobi. | ||

| − | * | + | *Despite government corruption, Amari has a growing entrepreneurial middle class and a gradually improving economic growth rate. |

| − | *Amari is an active player in the global economic order | + | *Amari is an active player in the global economic order with no international sanctions. |

| + | *Amari is a consistent major contributor to a regional economic monitoring group called the East African Cooperative Alignment (EACA)—a “coalition of the willing” that backs up market stability with military force on an as-needed basis. | ||

*Despite a relative abundance of natural resources, the government’s ability to provide basic services sometimes lags behind the population’s expectations. Electrical power is a case-in-point: Amari’s electrical grid suffers from episodic brown-outs and black outs, which occasionally causes episodes of political discontent. That said, electrical services in Amari are nonetheless qualitatively better than those provided in neighboring countries. | *Despite a relative abundance of natural resources, the government’s ability to provide basic services sometimes lags behind the population’s expectations. Electrical power is a case-in-point: Amari’s electrical grid suffers from episodic brown-outs and black outs, which occasionally causes episodes of political discontent. That said, electrical services in Amari are nonetheless qualitatively better than those provided in neighboring countries. | ||

| Line 28: | Line 26: | ||

|'''Measure''' | |'''Measure''' | ||

|'''Data''' | |'''Data''' | ||

| − | + | |'''Remarks (if applicable)''' | |

| − | |'''Remarks (if applicable)''' | ||

|- | |- | ||

| − | |'''GDP''' | + | |'''Nominal GDP''' |

| − | | | + | |$85.12 billion |

| − | | | + | |Agriculture 30.1%, Industry 19.7%, Services 50.2% |

| − | |||

|- | |- | ||

| − | |'''Labor | + | |'''Real GDP Growth Rate''' |

| − | | | + | |9.8% |

| − | | | + | |5 year average 19.4% |

| − | + | |- | |

| + | |'''Labor Force''' | ||

| + | |38.3 million | ||

| + | |Agriculture 60.1%, Industry 10.4%, Services 29.5% | ||

|- | |- | ||

|'''Unemployment''' | |'''Unemployment''' | ||

| − | | | + | |34.5% |

| − | | | + | | |

| − | |||

|- | |- | ||

|'''Poverty''' | |'''Poverty''' | ||

| − | |45% | + | |45.4% |

| − | | | + | |% of population living below the international poverty line |

| − | |||

|- | |- | ||

| − | |'''Investment''' | + | |'''Net Foreign Direct Investment''' |

| − | | | + | |$6.22 billion |

| − | + | |No outbound FDI | |

| − | |||

| − | | | ||

|- | |- | ||

|'''Budget''' | |'''Budget''' | ||

| − | |$ | + | |$14.21 billion revenue |

| − | $ | + | $38.25 billion expenditures |

| − | | | + | | |

| − | |||

|- | |- | ||

| − | |'''Public | + | |'''Public Dept.''' |

| − | | | + | |40.4% of GDP |

| − | | | + | | |

| − | |||

|- | |- | ||

|'''Inflation''' | |'''Inflation''' | ||

| − | | | + | |6.5% |

| − | | | + | |5 year average 15.5% |

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

|} | |} | ||

| Line 86: | Line 73: | ||

=== Foreign Direct Investment === | === Foreign Direct Investment === | ||

| − | Amari is an investor-friendly, open market economy that has achieved one of the fastest FDI increases in Africa over the past five years. FDI is encouraged in all sectors of the economy; agriculture, real estate, tourism and infrastructure projects are the leading areas for investment. The country boasts over 80 separate projects, ranging from real estate, to geothermal electrical power, to hydropower derived from the Nile, to development of roads, seaports, and railways. The recently completed Standard Gauge Railway from Nairobi to Mombasa is the largest project undertaken in Amari’s history, and is expected to employ just over 25,000 Amarians. Recent reforms adopted by the government aim to energize the country’s business landscape and mitigate risks to investors that could hamper growth projects. | + | Amari is an investor-friendly, open market economy that has achieved one of the fastest FDI increases in Africa over the past five years. FDI is encouraged in all sectors of the economy; agriculture, real estate, tourism and infrastructure projects are the leading areas for investment. The country boasts over 80 separate projects, ranging from real estate, to geothermal electrical power, to hydropower derived from the Nile, to development of roads, seaports, and railways. The recently completed [[Amari Infrastructure|Standard Gauge Railway]] from Nairobi to Mombasa is the largest project undertaken in Amari’s history, and is expected to employ just over 25,000 Amarians. Recent reforms adopted by the government aim to energize the country’s business landscape and mitigate risks to investors that could hamper growth projects. |

== Economic Activity == | == Economic Activity == | ||

| − | Amari’s economy is fundamentally based on a liberal foreign trade policy. GDP growth has been inconsistent since the country achieved independence in the mid-twentieth century, reaching its lowest point fifteen years ago when the IMF and World Bank intervened to prevent an economic crisis. As with some other African countries, endemic corruption mingles with a tradition of bureaucratic patronage that occasionally surfaces to create a drag on the economic growth. Inflation is a perennial problem: it reached a | + | Amari’s economy is fundamentally based on a liberal foreign trade policy. GDP growth has been inconsistent since the country achieved independence in the mid-twentieth century, reaching its lowest point fifteen years ago when the IMF and World Bank intervened to prevent an economic crisis. As with some other African countries, endemic corruption mingles with a tradition of bureaucratic patronage that occasionally surfaces to create a drag on the economic growth. Inflation is a perennial problem: it reached a high of 30% after the global economic downturn occurred ten years ago, but since leveled off to just under 10%. |

=== Economic Actors === | === Economic Actors === | ||

| Line 118: | Line 105: | ||

=== Commercial Trade === | === Commercial Trade === | ||

| − | + | Major export trading partners are Ziwa, Kujenga, Nyumba, the US, and western European countries. Major import trading partners include Olvana and selected countries in East Asia, Central Asia, and the Middle East. These bilateral trading relationships are regional to the extent that they include the East African community and the rest of Africa at large; and worldwide, as indicated by Amari’s major import trading partners. Amari offers foreign traders tea, cut flowers, coffee, raw petroleum, cashews, sisal, and pyrethrum. It imports machinery and transportation equipment, refined petroleum products, motor vehicles, iron and steel, resins, and plastics. Amari is highly integrated into the global economy and worldwide trading system. | |

=== Military Exports/Imports === | === Military Exports/Imports === | ||

| Line 126: | Line 113: | ||

== Economic Diversity == | == Economic Diversity == | ||

| − | Amari’s economy consists of multiple sectors, most notably agriculture, industry, and services. Of these, services is the most important, accounting for 50 % of the country’s GDP. Although 75 % of Amarians work at least part-time in the agricultural sector, this sector generates 30% of the GDP, and over 75% of agricultural output is derived from small-scale staple farming (especially tea) and livestock production. | + | Amari’s economy consists of multiple sectors, most notably agriculture, industry, and services. Of these, services is the most important, accounting for 50 % of the country’s GDP. Although 75 % of Amarians work at least part-time in the agricultural sector, this sector generates 30% of the GDP, and over 75% of agricultural output is derived from small-scale staple farming (especially tea) and livestock production. |

| + | |||

Tourism holds a significant place in Amari’s services sector. Two years ago, a spate of terrorist attacks led by the Mara-Suswa Rebel Army (MSRA) reduced international tourism. Most notorious was an attack on a game preserve near the Amari/Ziwa border that produced scores of casualties. Since that incident, the tourism industry has rebounded considerably. | Tourism holds a significant place in Amari’s services sector. Two years ago, a spate of terrorist attacks led by the Mara-Suswa Rebel Army (MSRA) reduced international tourism. Most notorious was an attack on a game preserve near the Amari/Ziwa border that produced scores of casualties. Since that incident, the tourism industry has rebounded considerably. | ||

| + | |||

Industry ranks third in importance (20% of GDP), compared to other two sectors of Amari’s economy. It produces small-scale consumer goods, agricultural support products, oil extraction equipment, and items to facilitate commercial ship repair. The country is dependent on imports to maintain its modest but growing industrial base. Maintaining food security and an acceptable standard of living for its population requires hefty imports of cereal grains. The government is generally supportive of cultivating a diverse, open-market, private enterprise economy, but its main economic shortfalls include legacy bureaucratic structures, endemic corruption, and persistent threats grounded in terrorism and criminal activity. | Industry ranks third in importance (20% of GDP), compared to other two sectors of Amari’s economy. It produces small-scale consumer goods, agricultural support products, oil extraction equipment, and items to facilitate commercial ship repair. The country is dependent on imports to maintain its modest but growing industrial base. Maintaining food security and an acceptable standard of living for its population requires hefty imports of cereal grains. The government is generally supportive of cultivating a diverse, open-market, private enterprise economy, but its main economic shortfalls include legacy bureaucratic structures, endemic corruption, and persistent threats grounded in terrorism and criminal activity. | ||

=== Energy Sector === | === Energy Sector === | ||

Amari both exports and imports petroleum products. Government authorities monitor the economy’s energy sector far more closely than other parts of the economy. This is particularly true of oil and gas extraction industries, where a significant nexus exists between Amari’s energy sector and the international trading community. | Amari both exports and imports petroleum products. Government authorities monitor the economy’s energy sector far more closely than other parts of the economy. This is particularly true of oil and gas extraction industries, where a significant nexus exists between Amari’s energy sector and the international trading community. | ||

| − | Five years ago the Shallow Oil Corporation discovered an estimated 750 million barrels of crude oil in the vicinity of Lake | + | Five years ago the Shallow Oil Corporation discovered an estimated 750 million barrels of crude oil in the vicinity of Lake Albert, which could potentially translate into approximately $40 billion worth of revenues for the Amari government. Recent projections indicate that revenues could reach almost $50 billion over the next few years as crude oil deposits may prove as large as a billion barrels. |

| − | Amari’s man issue with the oil and gas windfall lies in how to distribute the expected infusion of petrodollars internally among the different levels of government. Past experience in neighboring African states suggests that if no consensus can be reached on sharing oil revenues, foreign oil companies could pull out of the initial pilot scheme to explore and extract the newly discovered oil deposits. The same issue affects recently discovered Indian Ocean gas fields off Amari’s eastern coast. Meanwhile a Petroleum and Energy Bill that would establish ground-rules and an administrative framework to facilitate extraction was sidelined in the Amari parliament. | + | Amari’s man issue with the oil and gas windfall lies in how to distribute the expected infusion of petrodollars internally among the different levels of government. Past experience in neighboring African states suggests that if no consensus can be reached on sharing oil revenues, foreign oil companies could pull out of the initial pilot scheme to explore and extract the newly discovered oil deposits. The same issue affects recently discovered Indian Ocean gas fields off Amari’s eastern coast. Meanwhile a Petroleum and Energy Bill that would establish ground-rules and an administrative framework to facilitate extraction was sidelined in the Amari parliament. The quality of crude oil extracted from Amari fields ranks among the highest in the world. |

=== Oil === | === Oil === | ||

| − | New crude oil reserves were discovered in | + | New crude oil reserves were discovered in the Lake Albert (Albertine) Basin. Two Western companies drilled exploratory wells last year, and plan to sink a dozen more in the coming eighteen months. |

| − | Africa’s oil industry traditionally focused almost exclusively on the continent’s western region, with East Africa being largely overlooked. Of more than 30,000 wells drilled in Africa, fewer than 500 were in East Africa. Recent discoveries in Amari has awakened the world to the existence of a new basin of gigantic proportions. In the past, Amari produced insufficient oil to meet its own domestic energy needs, so it imported refined crude from abroad. One major former challenge that will persist despite the new discoveries is Amari’s severely limited indigenous refining capability, which consistently falls short of meeting the demands of its native population. | + | Africa’s oil industry traditionally focused almost exclusively on the continent’s western region, with East Africa being largely overlooked. Of more than 30,000 wells drilled in Africa, fewer than 500 were in East Africa. Recent discoveries in Amari has awakened the world to the existence of a new basin of gigantic proportions. In the past, Amari produced insufficient oil to meet its own domestic energy needs, so it imported refined crude from abroad. One major former challenge that will persist despite the new discoveries is Amari’s severely limited indigenous refining capability, which consistently falls short of meeting the demands of its native population. All refined petroleum products are currently imported. |

In the past, the proportional relationship between oil and gas usage was about equal. However, previous projections of such usage were dramatically changed by the discovery of the new oil basin discussed above, and the parallel discovery of natural gas fields in the Indian Ocean off Amari’s eastern coastline. Currently no government gasoline subsidies that would have any impact on fuel production and distribution exist, but that may change as the discoveries of new reserves translate into tangible petroleum output on a scale not previously witnessed in Amari. | In the past, the proportional relationship between oil and gas usage was about equal. However, previous projections of such usage were dramatically changed by the discovery of the new oil basin discussed above, and the parallel discovery of natural gas fields in the Indian Ocean off Amari’s eastern coastline. Currently no government gasoline subsidies that would have any impact on fuel production and distribution exist, but that may change as the discoveries of new reserves translate into tangible petroleum output on a scale not previously witnessed in Amari. | ||

| Line 158: | Line 147: | ||

=== Mining === | === Mining === | ||

| + | [[File:DATE Africa Mining Map.jpg|thumb]] | ||

Historically, Amari’s mining industry was not well developed, but today it stands on the cusp of positive change. Currently, the industry is best described as nascent. The country’s president recently signed a new mining act into law that is breathing new life into a formerly moribund industry. The previous mining law had been on the books since the midpoint of the twentieth century; some of the country’s geological data is a generation older than that. Amari missed out on a late twentieth-century mineral exploration boom that greatly benefitted neighboring competitors Ziwa and Kujenga. The national Ministry of Mining was created only five years ago. | Historically, Amari’s mining industry was not well developed, but today it stands on the cusp of positive change. Currently, the industry is best described as nascent. The country’s president recently signed a new mining act into law that is breathing new life into a formerly moribund industry. The previous mining law had been on the books since the midpoint of the twentieth century; some of the country’s geological data is a generation older than that. Amari missed out on a late twentieth-century mineral exploration boom that greatly benefitted neighboring competitors Ziwa and Kujenga. The national Ministry of Mining was created only five years ago. | ||

| Line 178: | Line 168: | ||

==== Petrochemicals ==== | ==== Petrochemicals ==== | ||

| − | Amari possesses very little petrochemical manufacturing capacity. Though Amari has considerable quantities of high quality raw crude oil, | + | Amari possesses very little petrochemical manufacturing capacity. Though Amari has considerable quantities of high quality raw crude oil, it has no active petroleum refineries. Refined products are imported into Mombasa and transported inland via [[Amari Infrastructure|pipeline]]. |

==== Defense Industries/Dual Use ==== | ==== Defense Industries/Dual Use ==== | ||

| Line 184: | Line 174: | ||

==== Services ==== | ==== Services ==== | ||

| − | Services are the most important of Amari’s three economic sectors, accounting for 50 percent of the country’s GDP. The same sector employs a third of the country’s labor pool | + | Services are the most important of Amari’s three economic sectors, accounting for 50 percent of the country’s GDP. The same sector employs a third of the country’s labor pool. Within the services sector, ecological tourism—focused on preservation of the numerous indigenous species of wildlife found in Amari—constitutes the most important subsector. About 3 years ago a series of attacks perpetrated by the MSRA significantly reduced tourism to Amari. Within the past year, however, tourism rebounded, growing by about 20 percent, while revenues from tourism increased by 40 percent. |

== Banking and Finance == | == Banking and Finance == | ||

| Line 191: | Line 181: | ||

During the past five years, government interference in open market dynamics decreased as a result of reforms implemented to establish a business-friendly economic environment that also is conducive to stimulating foreign investment. Although Amari has a growing entrepreneurial middle class, its economic development trajectory is hampered by entrenched oligarchs, weak governance, and corruption. Though selected private economic sectors are booming, nonprofit corporations suffer from a lack of professional oversight and accountability procedures. | During the past five years, government interference in open market dynamics decreased as a result of reforms implemented to establish a business-friendly economic environment that also is conducive to stimulating foreign investment. Although Amari has a growing entrepreneurial middle class, its economic development trajectory is hampered by entrenched oligarchs, weak governance, and corruption. Though selected private economic sectors are booming, nonprofit corporations suffer from a lack of professional oversight and accountability procedures. | ||

| − | Inflation is affecting | + | Inflation is significantly affecting the banking and finance community by increasing interest rates on loans, thus reducing available capital. In June this year, Amari’s inflation rate reached 10 percent, a level not seen during the preceding 5-year period. Though high, it is only a fraction of the 40 percent range witnessed two decades ago. |

The primary driver of Amari’s inflation is a 2 year long drought. The drought caused food price increases, jeopardizing the food security of citizens occupying lower rungs on the country’s socio-economic ladder. Inflationary pressure on food prices produced a collateral effect driving up prices on housing and utilities. Despite these quality of life issues, Amari authorities escaped much of the blame. Amari’s long-suffering population is generally resigned to episodic draught cycles, and views them as part of an inevitable natural order likely to persist in spite of everything government can do to curb inflationary pressures. | The primary driver of Amari’s inflation is a 2 year long drought. The drought caused food price increases, jeopardizing the food security of citizens occupying lower rungs on the country’s socio-economic ladder. Inflationary pressure on food prices produced a collateral effect driving up prices on housing and utilities. Despite these quality of life issues, Amari authorities escaped much of the blame. Amari’s long-suffering population is generally resigned to episodic draught cycles, and views them as part of an inevitable natural order likely to persist in spite of everything government can do to curb inflationary pressures. | ||

| Line 201: | Line 191: | ||

==== Currency Reserves ==== | ==== Currency Reserves ==== | ||

| − | Amari’s currency reserves have generally increased in recent years, despite a tendency for month-to-month fluctuation. They reached | + | Amari’s currency reserves have generally increased in recent years, despite a tendency for month-to-month fluctuation. They reached a recent all-time high of $11,250 million, compared with a record low of $853 million 12 years ago. Legal tender is the Amari shilling (Ashs). The current exchange rate is 100 Ashs per $1. |

==== Private Banking ==== | ==== Private Banking ==== | ||

Amari’s private banks, and related private establishments performing banking functions, include 45 major banks, 10 microfinance banks, 6 representative offices of foreign banks, 80 foreign exchange bureaus, 12 money remittance providers, and 2 credit reference bureaus. Government banking policies undergird sound banking practices by providing a country-wide framework, a codified set of ground rules, and stable environment conducive for operating private financial institutions. | Amari’s private banks, and related private establishments performing banking functions, include 45 major banks, 10 microfinance banks, 6 representative offices of foreign banks, 80 foreign exchange bureaus, 12 money remittance providers, and 2 credit reference bureaus. Government banking policies undergird sound banking practices by providing a country-wide framework, a codified set of ground rules, and stable environment conducive for operating private financial institutions. | ||

| − | Private | + | Private Banks seeking official sanction in Amari must obtain approval from the Central Bank of Amari before they can begin operations. This became problematic three years ago, when the government imposed a moratorium on establishing new private banking institutions pending passage of the Commercial Banking Act. This act was the intended medium for implementing reforms to instill improved professional practices and greater record-keeping transparency into the overall national system. The situation improved significantly over the past year once the Amari Commercial Banking Act (ACBA) became law. |

| − | Passage of ACBA facilitated government recognition of two more large banks, the | + | Passage of ACBA facilitated government recognition of two more large banks, the Play fair Bank, Limited, and the Amari Islamic Bank, a sharia-compliant bank with investment backing from selected Caucasus and Middle Eastern countries. If successful, these two new banks will increase the total number of major private banking institutions in Amari from 48 to 50, lending credence to observations made by some analysts suggesting that Amari is on the verge of becoming overbanked. |

==== Banking System ==== | ==== Banking System ==== | ||

| Line 221: | Line 211: | ||

Annual lending percentage rates vary by region and tend to be higher in sectors where large foreign investment appears to be imminent or has already taken hold. This is the case with areas in the vicinity of Lake Victoria (oil and precious metal exploration/extraction) and along the seacoast (anticipating a boom in refining and offshore natural gas exploration/extraction). | Annual lending percentage rates vary by region and tend to be higher in sectors where large foreign investment appears to be imminent or has already taken hold. This is the case with areas in the vicinity of Lake Victoria (oil and precious metal exploration/extraction) and along the seacoast (anticipating a boom in refining and offshore natural gas exploration/extraction). | ||

| − | Lending rates are seldom capped by the government, although governmental monitoring of micro and macro-economic activities inform monetary policies designed to achieve and maintain price-level stability. The central bank also acts to control inflation | + | Lending rates are seldom capped by the government, although governmental monitoring of micro and macro-economic activities inform monetary policies designed to achieve and maintain price-level stability. The central bank also acts to control inflation as the sole distributor of Amari currency, thus ensuring an adequate supply of clean currency to support social-economic activities. |

Business survey results suggest that corruption is problematic in the banking system, since companies encounter demands for bribes and informal payments considered necessary for “getting things done” in Amari. Six years ago the government established a new Anti-Corruption and Transparency Commission (ACTC), formed to replace an obsolete Amari Anti-Corruption Commission that never achieved legitimacy in the eyes of a skeptical public. To date, few if any businessmen or public officials have had charges preferred against them by the new commission. | Business survey results suggest that corruption is problematic in the banking system, since companies encounter demands for bribes and informal payments considered necessary for “getting things done” in Amari. Six years ago the government established a new Anti-Corruption and Transparency Commission (ACTC), formed to replace an obsolete Amari Anti-Corruption Commission that never achieved legitimacy in the eyes of a skeptical public. To date, few if any businessmen or public officials have had charges preferred against them by the new commission. | ||

| Line 232: | Line 222: | ||

Amari’s national stock exchange has witnessed considerable volatility over the past 10 years, mostly as a result of indirect effects of famine, and episodic bouts of investor trepidation caused by domestic political upheaval. It reached an all-time high of 5,500 points two years ago prior to the onset of the current drought. It sank to a record low of 2,800 early last year, partially because of the prolonged drought, partially because of concerns of potential violence surrounding scheduled elections. There is a growing consensus, however, that the market has bottomed-out, and projections for the coming six months are positive. | Amari’s national stock exchange has witnessed considerable volatility over the past 10 years, mostly as a result of indirect effects of famine, and episodic bouts of investor trepidation caused by domestic political upheaval. It reached an all-time high of 5,500 points two years ago prior to the onset of the current drought. It sank to a record low of 2,800 early last year, partially because of the prolonged drought, partially because of concerns of potential violence surrounding scheduled elections. There is a growing consensus, however, that the market has bottomed-out, and projections for the coming six months are positive. | ||

| − | Expressed in dollars, the average stock market capitalization for Amari for the past fifteen years was $6 billion, with a minimum of $1 billion 17 years ago, and a maximum of $10 billion 7 years ago | + | Expressed in dollars, the average stock market capitalization for Amari for the past fifteen years was $6 billion, with a minimum of $1 billion 17 years ago, and a maximum of $10 billion 7 years ago. |

==== Informal Finance ==== | ==== Informal Finance ==== | ||

As in many other African countries, Amari has a large informal finance sector due primarily to a lack of jobs in the formal sector and longstanding cultural biases and superstitions that prejudice the population against participation in the formal economy. Informal employment may fall into agricultural, industrial, or service categories and encompasses work as diverse as agricultural labor, trade, manufacturing, repair services, and domestic work. Refugees from other countries and children frequently obtain employment in this sector in order to bypass legal restrictions. | As in many other African countries, Amari has a large informal finance sector due primarily to a lack of jobs in the formal sector and longstanding cultural biases and superstitions that prejudice the population against participation in the formal economy. Informal employment may fall into agricultural, industrial, or service categories and encompasses work as diverse as agricultural labor, trade, manufacturing, repair services, and domestic work. Refugees from other countries and children frequently obtain employment in this sector in order to bypass legal restrictions. | ||

| − | As previously indicated, Amari’s private banking system—as an integral part of the country’s formal economy--includes 12 money remittance providers who provide support to Amari’s sizeable diaspora | + | As previously indicated, Amari’s private banking system—as an integral part of the country’s formal economy--includes 12 money remittance providers who provide support to Amari’s sizeable diaspora. Despite this arrangement, some prefer to channel their remittances through an alternative informal transfer infrastructure called the hawala system. This is an informal trust-based network of individuals that avoids government involvement and sometimes offers a better exchange rate. Such transactions are not without risk, as the state levies prison sentences and financial penalties on those who are caught. Other informal economic activities include barter, the sale of wood and charcoal, and the sale of basic foodstuffs such as meat or sugar. |

== Employment Status == | == Employment Status == | ||

| Line 247: | Line 237: | ||

The national labor force is getting younger, and the working-age population is more than sufficient to replace any vacancies in the workplace. The challenge is not a shortage of jobs, but a shortage of trained/skilled workers competent to fill high productivity positions. | The national labor force is getting younger, and the working-age population is more than sufficient to replace any vacancies in the workplace. The challenge is not a shortage of jobs, but a shortage of trained/skilled workers competent to fill high productivity positions. | ||

| − | === Employment === | + | === Employment and Unemployment === |

Over the past ten years Amari’s unemployment rate has ranged from 25% to 40%, with the higher figures being prevalent more recently because of a combination of persistent drought and a burgeoning refugee population fleeing terrorist threats in neighboring countries. Private sector job growth is increasing (with a corresponding shrinkage of growth in the public sector) as government measures designed to attract private enterprise and foreign investment take hold. | Over the past ten years Amari’s unemployment rate has ranged from 25% to 40%, with the higher figures being prevalent more recently because of a combination of persistent drought and a burgeoning refugee population fleeing terrorist threats in neighboring countries. Private sector job growth is increasing (with a corresponding shrinkage of growth in the public sector) as government measures designed to attract private enterprise and foreign investment take hold. | ||

| Line 253: | Line 243: | ||

=== Illegal Economic Activity === | === Illegal Economic Activity === | ||

| − | Illegal economic activity in Amari cannot be entirely separated from chronic poverty and famine | + | Illegal economic activity in Amari cannot be entirely separated from chronic poverty and famine. In the country’s eastern lowlands, an ethnic dimension also factors in, as tribes with an historic tradition of mutual hostility compete for scarce natural resources. Nomadic migration spawned a longstanding tradition of cattle rustling and banditry, often accompanied by ethnic clashes in remote rural districts. The current ongoing drought made conditions worse, featuring armed pastoralists invading private land—including corporate land—in search of dwindling water and grazing resources. |

| − | |||

| − | |||

| − | Organized crime threatens legitimate business activity in Amari. Political corruption, nepotism, and ethnic favoritism also affect the business sector and exacerbate existing imbalances in wealth and access to economic opportunities, including public sector jobs. It is estimated the average urban Amari pays 10 bribes per month. Most of these bribes are fairly small, but large ones are also taken: bribes worth over $700 account for 40% of the total. There is also corruption on a larger scale: the two most recent ruling regimes were implicated in bribery directly and indirectly. | + | Organized crime threatens legitimate business activity in Amari. Political corruption, nepotism, and ethnic favoritism also affect the business sector and exacerbate existing imbalances in wealth and access to economic opportunities, including public sector jobs. It is estimated the average urban Amari pays 10 bribes per month. Most of these bribes are fairly small, but large ones are also taken: bribes worth over $700 account for 40% of the total. There is also corruption on a larger scale: the two most recent ruling regimes were implicated in bribery directly and indirectly. Leading political figures or cabinet ministers are rarely charged with corruption. |

| − | In Amari it is often difficult to distinguish | + | In Amari it is often difficult to distinguish between informal and illegal economic activity. It often a matter of scale and perspective. In remote areas where subsistence farming is prevalent, bartering for goods and services is a routine practice. It is occasionally even preferred to money because you can eat a chicken, but not metal or paper currency. Thus, authorities are inclined to turn a blind eye towards bartering, even in cases where it deprives the government of legally mandated tax revenue. This is most common in those cases where small-scale subsistence farmers or herdsmen depend on the informal economy to meet their basic needs. |

Authorities take a much greater interest in enforcing tax codes and regulations when activities like poaching and illegal mining reach a certain tipping point. North Torbia and the People’s Republic of Olvana recently came under intense international scrutiny for largescale poaching of Amari wildlife. Their diplomats allegedly tried to smuggle sizeable quantities of rhino and elephant ivory out of the country for resale at a considerable profit in their respective domestic markets. This illicit trading in wildlife—especially including elephants and rhinos—not only endangers the targeted species, but also jeopardizes the lucrative tourist industry, a vital component of Amari’s economy. | Authorities take a much greater interest in enforcing tax codes and regulations when activities like poaching and illegal mining reach a certain tipping point. North Torbia and the People’s Republic of Olvana recently came under intense international scrutiny for largescale poaching of Amari wildlife. Their diplomats allegedly tried to smuggle sizeable quantities of rhino and elephant ivory out of the country for resale at a considerable profit in their respective domestic markets. This illicit trading in wildlife—especially including elephants and rhinos—not only endangers the targeted species, but also jeopardizes the lucrative tourist industry, a vital component of Amari’s economy. | ||

| Line 271: | Line 259: | ||

Ancillary forms of illegal economic activity—including piracy, smuggling, human trafficking, and bribing government officials—all feed into and accrue funding through the criminal drug trade. The Hodari Heroin Cartel exerts a corrupting influence at port facilities to ensure the uninterrupted movement of illegal drugs. At times this extends to jeopardizing legitimate trading vessels plying Amari coastal waters, since forces or goods transiting the Port of Mombasa risk encountering pirates in the pay of the cartel or its affiliates. | Ancillary forms of illegal economic activity—including piracy, smuggling, human trafficking, and bribing government officials—all feed into and accrue funding through the criminal drug trade. The Hodari Heroin Cartel exerts a corrupting influence at port facilities to ensure the uninterrupted movement of illegal drugs. At times this extends to jeopardizing legitimate trading vessels plying Amari coastal waters, since forces or goods transiting the Port of Mombasa risk encountering pirates in the pay of the cartel or its affiliates. | ||

| − | The Islamic Front in the Heart of Africa (AFITHA) | + | The Islamic Front in the Heart of Africa (AFITHA) conducts smuggling, human trafficking, and kidnapping-for-ransom activities to raise funds in support of its cause. This is particularly the case with its efforts to facilitate the spread of militant Islamist ideology by gaining access to global state-of-the-art technology and know-how. AFITHA’s regional perception management activities include waging an incessant information warfare (INFOWAR) campaign utilizing social media and the worldwide web. |

The Amari National Defense Force (ANDF), like some counterparts in the East Africa region, directs its own INFOWAR efforts against all likely adversaries. These include hostile militant groups, and allegedly also domestic political factions opposed to current government policies, and selected international business interests. Meanwhile, groups like the above-mentioned AFITHA and the Pemba Digital Army (PDA) attempt to counter Amari INFOWAR efforts to undermine or neutralize insurgent capabilities. | The Amari National Defense Force (ANDF), like some counterparts in the East Africa region, directs its own INFOWAR efforts against all likely adversaries. These include hostile militant groups, and allegedly also domestic political factions opposed to current government policies, and selected international business interests. Meanwhile, groups like the above-mentioned AFITHA and the Pemba Digital Army (PDA) attempt to counter Amari INFOWAR efforts to undermine or neutralize insurgent capabilities. | ||

| Line 277: | Line 265: | ||

Another organization, the Bonkeri, operates with the blessing of the Amari government, but its activities are considered criminal in nature by many members of the international community. The Bonkeri conduct clandestine government-sanctioned political and financial hacking of networks to achieve goals established by Amari’s current ruling political faction. In reality, this organization provides a venue for the freelance hacking of foreign computer systems, in order to serve the national interests of Amari. It is an open secret that the Bonkeri organization has been penetrated by elements associated with the Hodari Heroin Cartel. The end result is a virtual bazaar where state-of-the-art perception management technology and expertise can be purchased by the highest bidder, whether state or non-state actor, with little attention paid to the preferred ideology, motivation, or tactics of the buyer. | Another organization, the Bonkeri, operates with the blessing of the Amari government, but its activities are considered criminal in nature by many members of the international community. The Bonkeri conduct clandestine government-sanctioned political and financial hacking of networks to achieve goals established by Amari’s current ruling political faction. In reality, this organization provides a venue for the freelance hacking of foreign computer systems, in order to serve the national interests of Amari. It is an open secret that the Bonkeri organization has been penetrated by elements associated with the Hodari Heroin Cartel. The end result is a virtual bazaar where state-of-the-art perception management technology and expertise can be purchased by the highest bidder, whether state or non-state actor, with little attention paid to the preferred ideology, motivation, or tactics of the buyer. | ||

| − | |||

[[Category:DATE]] | [[Category:DATE]] | ||

[[Category:Africa]] | [[Category:Africa]] | ||

[[Category:Amari]] | [[Category:Amari]] | ||

[[Category:Economic]] | [[Category:Economic]] | ||

Latest revision as of 19:53, 2 July 2020

Amarian topography supports abundant natural resources and numerous forms of wildlife of scientific and economic value. Amari has a mixed open market economy that includes a variety of privately owned businesses, combined with moderate centralized economic planning and government regulation. Amari is a member of the East African Community (EAC).

Key Points

- Ongoing oil and gas exploration in and around Lake Albert and the Indian Ocean has proved lucrative.

- Like other countries in the region, Amari is blessed with abundant natural resources. Amari enjoys the added advantage of greater economic development and a more advanced infrastructure than its neighbors.

- Amari is the economic, financial, and transport hub of East Africa, although agriculture remains the backbone of its economy.

- Ziwa, and to a lesser extent Kujenga, are Amari’s main regional economic competitors. Although these three countries compete for regional economic superiority, they have demonstrated a capability to cooperate to accomplish goals shared in the common interest such as security and eco-tourism.

- Economists generally consider Amari as East Africa’s economic hegemon.

- Although governmental regulation and excessive bureaucracy have adversely impacted the economy in the past, recently enacted reforms designed are attracting entrepreneurs and more foreign investors. The government sees itself as an honest broker in ensuring that the marketplace operates fairly, and in the interests of the nation at large.

- Corruption and collusion between economic oligarchs and government officials create a drag on economic progress.

- Over the past 18 months the government was forced to take over a handful of undercapitalized banks and enact measures to limit the amount of interest banks can charge on loans. These measures caused a temporary shrinkage of credit availability in Amari. Since that time, the economy has rebounded at a moderate pace.

- Amari has a robust export economy. Exports include tea, cashews, coffee, cut flowers, sisal, cotton, and Pyrethrum. Amari relies on imports for machinery and transportation equipment, motor vehicles, refined petroleum products, resins and plastics. Despite the large agricultural economy, the country does not grow enough cereal grains to feed its population.

- Several successive political regimes relied on international and financial institutions to underwrite national economic growth and development investments. An Olvanese company recently completed construction of a new standard gauge railway connecting Mombasa and Nairobi.

- Despite government corruption, Amari has a growing entrepreneurial middle class and a gradually improving economic growth rate.

- Amari is an active player in the global economic order with no international sanctions.

- Amari is a consistent major contributor to a regional economic monitoring group called the East African Cooperative Alignment (EACA)—a “coalition of the willing” that backs up market stability with military force on an as-needed basis.

- Despite a relative abundance of natural resources, the government’s ability to provide basic services sometimes lags behind the population’s expectations. Electrical power is a case-in-point: Amari’s electrical grid suffers from episodic brown-outs and black outs, which occasionally causes episodes of political discontent. That said, electrical services in Amari are nonetheless qualitatively better than those provided in neighboring countries.

Table of Economic Data

| Measure | Data | Remarks (if applicable) |

| Nominal GDP | $85.12 billion | Agriculture 30.1%, Industry 19.7%, Services 50.2% |

| Real GDP Growth Rate | 9.8% | 5 year average 19.4% |

| Labor Force | 38.3 million | Agriculture 60.1%, Industry 10.4%, Services 29.5% |

| Unemployment | 34.5% | |

| Poverty | 45.4% | % of population living below the international poverty line |

| Net Foreign Direct Investment | $6.22 billion | No outbound FDI |

| Budget | $14.21 billion revenue

$38.25 billion expenditures |

|

| Public Dept. | 40.4% of GDP | |

| Inflation | 6.5% | 5 year average 15.5% |

Participation in the Global Financial System

Amari is better integrated into the global financial system that many of its neighbors. That said, in its post-colonial quest for development, the country displays an eclectic attitude in selecting its trading partners. While generally gravitating toward western markets, Amari sometimes veers toward tempting opportunities offered by the Olvanese. They represent a convenient source of “quick fix” development loans offered with few strings attached, and few caveats related to corruption, human rights practices, and what Olvana deems as the “internal affairs” of Amari’s government.

World Bank/International Development Aid

The World Bank maintains several portfolios for Amari. The main focus of World Bank support over the past decade targets infrastructure venues in the private sector, particularly geothermal and hydroelectric power generation. Seven years ago the World Bank issued $160 million in loans to construct 4 geothermal energy facilities at selected locations in the Eastern Rift Valley. The World Bank also underwrote loans for hydropower to be derived from Nile River sources. Although the US and Western Europe comprise the primary donors for most of these projects, Amari recently turned to Olvana for construction of a modern railway connecting Nairobi and Mombasa. World Bank and Western European bilateral donors provided development funds in support of “climate-smart” farms designed to help small freeholders mitigate the effect of droughts that periodically afflict the East African region.

Foreign Direct Investment

Amari is an investor-friendly, open market economy that has achieved one of the fastest FDI increases in Africa over the past five years. FDI is encouraged in all sectors of the economy; agriculture, real estate, tourism and infrastructure projects are the leading areas for investment. The country boasts over 80 separate projects, ranging from real estate, to geothermal electrical power, to hydropower derived from the Nile, to development of roads, seaports, and railways. The recently completed Standard Gauge Railway from Nairobi to Mombasa is the largest project undertaken in Amari’s history, and is expected to employ just over 25,000 Amarians. Recent reforms adopted by the government aim to energize the country’s business landscape and mitigate risks to investors that could hamper growth projects.

Economic Activity

Amari’s economy is fundamentally based on a liberal foreign trade policy. GDP growth has been inconsistent since the country achieved independence in the mid-twentieth century, reaching its lowest point fifteen years ago when the IMF and World Bank intervened to prevent an economic crisis. As with some other African countries, endemic corruption mingles with a tradition of bureaucratic patronage that occasionally surfaces to create a drag on the economic growth. Inflation is a perennial problem: it reached a high of 30% after the global economic downturn occurred ten years ago, but since leveled off to just under 10%.

Economic Actors

For the past 5 years, the tea industry has been Amari’s most significant success story: tea farmers are able to count on this agricultural staple crop as an income earner. Although the corporate behemoth Amari Tea Cultivation Agency (ATCA) can still exert undue influence on tea-growing subsistence farmers, recent government reforms initiated on behalf of small landholders mitigated monopolistic influences that formerly placed independent landholders at a disadvantage.

Amari’s aviation sector is one of the best developed in Africa. This bodes well both for the economy at large, as well as for Amari Airways, the country’s flagship air carrier. Since aviation is a cornerstone of global trade and tourism, enhanced connectivity inherent in air travel spurs economic productivity by linking Amari to the world at large, and also by promoting intra-continental and regional East African trade.

Amari’s national security forces have a negligible impact of the country’s economic arena, especially with regard to the dynamics of the open market economy. Military expenditures over the past five years have ranged between 1.33% and 2% of the country’s GDP; last year the figure stood at 1.33%. While some former military personnel are members of the country’s social/military/industrial oligarchy, their participation is on an anecdotal scale, existing within a newly reformed political tradition of separating the military from economic and political power structures.

Charitable organizations in Amari play an important role advocating for deprived/marginalized socio-economic classes and special interest groups. Among these non-governmental organizations (NGOs), the most important are the African Wildlife Protective Perimeter (AWPP), Family Hygiene International (FHI), Doctors Universal (DU), and the Former Military Officers’ Association (FMOA). Few of the 70 charitable organizations deviate from their legitimate role as advocates for their constituents by entering the realm of exerting undue political pressure on government authorities. This relatively stable state of affairs results largely from ground-rules codified by the Non-Governmental Organizations Control Act of 2015.

Amari’s economic philosophy is based on open markets and private enterprise. Its success largely depends on the resilience, resourcefulness, and expanding popular confidence in the private sector. Since achieving independence, the negative experiences of managing unwieldy, bureaucratic, state-run corporations made Amari’s leaders wary of centralized economic planning. However, they still regard themselves honest brokers in maintaining a healthy balance between protecting the public interest and open market competition. The newly-built Mombasa-Nairobi railway provides an apt example of how this balance operates in practice. Although the rail line itself is a privately-run corporation, government guidelines and oversight ensure that fares are kept to a minimum, thus guaranteeing affordable rail travel to the vast majority of Amarians.

The country’s business interests—large and small—are proud of Amari’s top ranking in African economic development. They generally appreciate the degree to which continued prosperity largely depends on the competitive dynamics of the open market. Although endemic corruption remains an ever-present danger, business leaders are generally supportive of the reforms needed to keep the system honest. Future economic growth and achieving Amari’s national potential require still more deregulation of business, improved delivery of basic services, and continued major investments in infrastructure, especially roads and port facilities.

In the past, some groups have used boycotts and strikes as tactics of last resort in pressuring the government and opposing interest groups to agree to their demands. Such tactics typically backfired, bringing popular disapproval of the groups involved. In addition, they created negative effects on the national economy as a whole by stifling the willingness of foreign investors to infuse funds into national infrastructure development projects.

Trade

Foreign trade is a cornerstone of Amari’s economy. The Amari Tea Cultivation Agency is currently the country’s largest tea grower and exporter, generating 30% of Amari’s export revenues, and incidentally making the country the world’s third largest exporter of Black tea.

Besides tea, fresh horticulture products—especially cut flowers—are major drivers of Amari trade. However, these products are vulnerable to famine, infestation, and ambivalent weather conditions that can negatively availability year-to-year.

Despite its large agricultural economy, Amari does not grow enough cereal grains to feed its indigenous population. These products are therefore imported through bilateral agreements with trading partners.

Amari benefits significantly from the African Growth and Opportunities Act, approved by the US Congress seventeen years ago. This act assists the economies of sub-Saharan Africa and improves economic relations between the US and the region. Agricultural products are a lucrative sector of bilateral US-Amari trade, but improvements still need to be made in order to meet US customs and sanitary standards.

Amari is currently free of any international restrictions or sanctions that would inhibit its participation in the import/export trade.

Commercial Trade

Major export trading partners are Ziwa, Kujenga, Nyumba, the US, and western European countries. Major import trading partners include Olvana and selected countries in East Asia, Central Asia, and the Middle East. These bilateral trading relationships are regional to the extent that they include the East African community and the rest of Africa at large; and worldwide, as indicated by Amari’s major import trading partners. Amari offers foreign traders tea, cut flowers, coffee, raw petroleum, cashews, sisal, and pyrethrum. It imports machinery and transportation equipment, refined petroleum products, motor vehicles, iron and steel, resins, and plastics. Amari is highly integrated into the global economy and worldwide trading system.

Military Exports/Imports

Amari is not a major player in the worldwide arms trade, and does not export significant quantities of military hardware. Though arms importers may be located in anywhere on the globe, Western-manufactured products are preferred due to their quality. After 2000, Amari’s government evinced a desire to increase interoperability between Amarian and US military forces. The offshoot was a bilateral agreement that would allow Amari’s military to modernize with US and UK-manufactured equipment. Current arrangements, however, are all subject to political expediency, and Amari’s eclectic approach to modernizing and equipping its military does not rule out similar bilateral arrangements with other international or regional powers.

Amari’s military expenditure is less than 2% of GDP. Funds expended for military research and development are negligible. The country is not well situated for meeting future maintenance, spare parts, and upgrade needs for its military, nor does it have a sufficiently well-developed industrial base to support a military export trade. Amari is wholly dependent on foreign trade to compensate for military technology gaps, and a deep sense of post-colonial national pride is the main catalyst for devoting resources towards military modernization and upgrades.

Economic Diversity

Amari’s economy consists of multiple sectors, most notably agriculture, industry, and services. Of these, services is the most important, accounting for 50 % of the country’s GDP. Although 75 % of Amarians work at least part-time in the agricultural sector, this sector generates 30% of the GDP, and over 75% of agricultural output is derived from small-scale staple farming (especially tea) and livestock production.

Tourism holds a significant place in Amari’s services sector. Two years ago, a spate of terrorist attacks led by the Mara-Suswa Rebel Army (MSRA) reduced international tourism. Most notorious was an attack on a game preserve near the Amari/Ziwa border that produced scores of casualties. Since that incident, the tourism industry has rebounded considerably.

Industry ranks third in importance (20% of GDP), compared to other two sectors of Amari’s economy. It produces small-scale consumer goods, agricultural support products, oil extraction equipment, and items to facilitate commercial ship repair. The country is dependent on imports to maintain its modest but growing industrial base. Maintaining food security and an acceptable standard of living for its population requires hefty imports of cereal grains. The government is generally supportive of cultivating a diverse, open-market, private enterprise economy, but its main economic shortfalls include legacy bureaucratic structures, endemic corruption, and persistent threats grounded in terrorism and criminal activity.

Energy Sector

Amari both exports and imports petroleum products. Government authorities monitor the economy’s energy sector far more closely than other parts of the economy. This is particularly true of oil and gas extraction industries, where a significant nexus exists between Amari’s energy sector and the international trading community.

Five years ago the Shallow Oil Corporation discovered an estimated 750 million barrels of crude oil in the vicinity of Lake Albert, which could potentially translate into approximately $40 billion worth of revenues for the Amari government. Recent projections indicate that revenues could reach almost $50 billion over the next few years as crude oil deposits may prove as large as a billion barrels.

Amari’s man issue with the oil and gas windfall lies in how to distribute the expected infusion of petrodollars internally among the different levels of government. Past experience in neighboring African states suggests that if no consensus can be reached on sharing oil revenues, foreign oil companies could pull out of the initial pilot scheme to explore and extract the newly discovered oil deposits. The same issue affects recently discovered Indian Ocean gas fields off Amari’s eastern coast. Meanwhile a Petroleum and Energy Bill that would establish ground-rules and an administrative framework to facilitate extraction was sidelined in the Amari parliament. The quality of crude oil extracted from Amari fields ranks among the highest in the world.

Oil

New crude oil reserves were discovered in the Lake Albert (Albertine) Basin. Two Western companies drilled exploratory wells last year, and plan to sink a dozen more in the coming eighteen months.

Africa’s oil industry traditionally focused almost exclusively on the continent’s western region, with East Africa being largely overlooked. Of more than 30,000 wells drilled in Africa, fewer than 500 were in East Africa. Recent discoveries in Amari has awakened the world to the existence of a new basin of gigantic proportions. In the past, Amari produced insufficient oil to meet its own domestic energy needs, so it imported refined crude from abroad. One major former challenge that will persist despite the new discoveries is Amari’s severely limited indigenous refining capability, which consistently falls short of meeting the demands of its native population. All refined petroleum products are currently imported.

In the past, the proportional relationship between oil and gas usage was about equal. However, previous projections of such usage were dramatically changed by the discovery of the new oil basin discussed above, and the parallel discovery of natural gas fields in the Indian Ocean off Amari’s eastern coastline. Currently no government gasoline subsidies that would have any impact on fuel production and distribution exist, but that may change as the discoveries of new reserves translate into tangible petroleum output on a scale not previously witnessed in Amari.

Natural Gas

Amari natural gas resources were considered negligible until five years ago, when discoveries by an Australian oil and gas exploration firm proved to be a game-changer. The company stated that off Amari’s eastern shore, it encountered 50 meters of net pay in gas-charged sands located at an exploratory well. It is estimated that this well holds between 2.2 trillion and 5 trillion cubic feet of potentially recoverable gas, a mean resource value of 200 million to 300 million barrels. A gas company spokesman observed that it would be hard to overestimate the significance of this exploratory drilling success in what effectively amounted to a virgin area. The initial exploratory effort was the first in a new wave of discoveries that ensued in Amari’s offshore region.

Because of the offshore nature of these discoveries, they may also benefit Amari’s northern and southern neighbors—Nyumba and Kujenga respectively—and sharpen the export trade competition among all three countries. No international sanctions are in place that would inhibit natural gas production in the three countries, or limit their participation in the gas export trade.

Although Amari is an importer of liquefied natural gas from the United States, imported quantities could decrease over time as Amari’s domestic extraction and refining infrastructure come online. North American and Western European countries are expected to play a mentoring role as Amari’s natural gas generating capacities develop. That said, Amari may well take an eclectic/opportunistic approach to development that would not rule-out Donovia, Olvana, and selected Asian or Middle Eastern countries from assuming mentorship roles.

Agriculture

Agricultural production accounts for one-third of Amari’s GDP, and 75 percent of its 19-million-strong workforce is involved in agricultural production. About half of Amari’s total agricultural output is non-market subsistence farming, sometimes undertaken to augment meagre incomes garnered from working in other economic sectors. Amari’s main agricultural exports include coffee, tea, poultry, and dairy products. Although most of the country’s imports originate outside the agricultural sphere, Amari also imports modest quantities of raw sugar, sawa weed, and wheat to augment its domestic production of these commodities.

Amari’s government is actively engaged in promoting scientific farming and best practices in agriculture. The Amari Agricultural Research Foundation (AARF) is chartered to act as a clearing house for research programs in food crops, horticultural and industrial crops, livestock and range management, and land and water management. AARF promotes sound agricultural research and technology generation and dissemination to enhance food security through improved productivity and sound environmental conservation practices.

Amari provides subsidies to keep fertilizer prices low for maize farmers, and its Ministry of Agriculture distributes seed at reduced prices through agencies like the Amari Seed Company. The government is concerned that reduction or revocation of these subsidies could jeopardize the food security of its citizens, particularly subsistence farmers. This concern was compounded the past two years, as all of East Africa struggled with an Army Worm infestation of the maize crop. Other than government advocacy of best farming practices and support for subsidies, the country’s agricultural production is driven primarily by the open market.

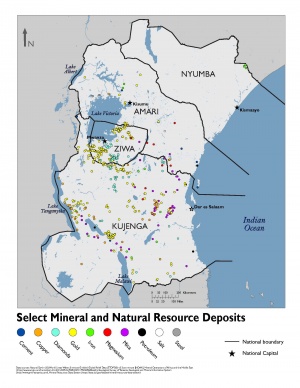

Mining

Historically, Amari’s mining industry was not well developed, but today it stands on the cusp of positive change. Currently, the industry is best described as nascent. The country’s president recently signed a new mining act into law that is breathing new life into a formerly moribund industry. The previous mining law had been on the books since the midpoint of the twentieth century; some of the country’s geological data is a generation older than that. Amari missed out on a late twentieth-century mineral exploration boom that greatly benefitted neighboring competitors Ziwa and Kujenga. The national Ministry of Mining was created only five years ago.

A dynamic new mining minister codified a strategy that seeks to attract a considerable number of private operators over the next 20 years, with the goal of mining reaching 10% of Amari’s GDP. This could potentially translate into $7 billion of mining revenue. Before the new mining law was passed, prevailing government policies and excessive regulation discouraged outside investment. Now, potential foreign investors sense the Amarian mining sector is at the starting gate, and all concerned are ready to get things moving.

Besides attracting foreign investors, the government foresees registering thousands of the country’s informal miners—most of whom pan for gold on Amari’s side of Lake Victoria—and expanding the meager gemstone industry. The actual size of Amari’s mineral reserves are largely a matter of speculation, but industry experts are optimistic. One company chief executive officer observed that the country doesn’t even know what it’s got, since about 95% of the geological formations running north from Kujenga have yet to be mapped.

Manufacturing

The manufacturing sector of Amari’s economy, though robust by East African standards, is still in the developmental stages compared with the US and Western Europe. As noted above, agricultural production accounts for about one-third of the country’s GDP; manufacturing accounts for 20%. Manufacturing industries include small-scale consumer goods (plastic, furniture, batteries, textiles, clothing, soap, cigarettes, and flour); Oil refining and aluminum, steel, lead, and cement production; and commercial ship repair.

Amari’s industrial production ranks first among East African states but 35th in world at large.

Steel

Amari’s domestic steel industry does not register on either a regional or worldwide scale. Since no local sources have been developed, Amari’s domestic iron and steel industry is heavily dependent on imported raw materials, Local deposits of iron ore and coal—the raw materials prerequisite for steel production—have yet to attract significant outside foreign investment interest.

Amari recently embarked on an ambitious industrial transformation plan that envisions increasing the manufacturing sector of the economy to 30 % over the next five years (it now stands at 20%). In order to accomplish that goal, domestic iron and steel manufacturing must expand. The iron and steel industry in Amari now forms about 13 percent of the manufacturing sector.

Automotives

No major domestic automotive production capability exists in Amari; the country is heavily reliant on imports to meet its domestic transportation needs and military hardware requirements. Completion of the Nairobi-Mombasa railway, built mainly with Olvanese materiel, funding, and oversight, typifies Amari’s reliance on external transportation technology and know-how. The country does not possess a reliable domestic spare parts industry that could operate in support of large-scale vehicle production. Environmental pollution from automotive emissions is a concern.

Petrochemicals

Amari possesses very little petrochemical manufacturing capacity. Though Amari has considerable quantities of high quality raw crude oil, it has no active petroleum refineries. Refined products are imported into Mombasa and transported inland via pipeline.

Defense Industries/Dual Use

Although Amari aspires to modernize its military and increase the degree of interoperability between its own and foreign military forces, the industrial base supporting defense is limited to a single factory producing small arms. Domestic know-how in reverse engineering and replicating technologically advanced products is lacking in Amari, and procurement of these technologies is almost entirely dependent on commercial off-the-shelf sources. Transitioning the national industrial base from a peacetime to wartime footing will not be feasible without significant development in the manufacturing sector.

Services

Services are the most important of Amari’s three economic sectors, accounting for 50 percent of the country’s GDP. The same sector employs a third of the country’s labor pool. Within the services sector, ecological tourism—focused on preservation of the numerous indigenous species of wildlife found in Amari—constitutes the most important subsector. About 3 years ago a series of attacks perpetrated by the MSRA significantly reduced tourism to Amari. Within the past year, however, tourism rebounded, growing by about 20 percent, while revenues from tourism increased by 40 percent.

Banking and Finance

Public Finance

During the past five years, government interference in open market dynamics decreased as a result of reforms implemented to establish a business-friendly economic environment that also is conducive to stimulating foreign investment. Although Amari has a growing entrepreneurial middle class, its economic development trajectory is hampered by entrenched oligarchs, weak governance, and corruption. Though selected private economic sectors are booming, nonprofit corporations suffer from a lack of professional oversight and accountability procedures.

Inflation is significantly affecting the banking and finance community by increasing interest rates on loans, thus reducing available capital. In June this year, Amari’s inflation rate reached 10 percent, a level not seen during the preceding 5-year period. Though high, it is only a fraction of the 40 percent range witnessed two decades ago.

The primary driver of Amari’s inflation is a 2 year long drought. The drought caused food price increases, jeopardizing the food security of citizens occupying lower rungs on the country’s socio-economic ladder. Inflationary pressure on food prices produced a collateral effect driving up prices on housing and utilities. Despite these quality of life issues, Amari authorities escaped much of the blame. Amari’s long-suffering population is generally resigned to episodic draught cycles, and views them as part of an inevitable natural order likely to persist in spite of everything government can do to curb inflationary pressures.

Taxation

Equitable application of tax codes in Amari is improving as government reforms—including standardization of definitions and appellate procedures—take effect. The statutory tax rate for corporations is 30 percent, as is the personal income tax rate for private citizens. The universal national sales tax rate stands at 15 percent. Social Security taxes total ten percent of wages, five percent each paid respectively by employees and employers.

Recent government reforms currently being translated into tax policies are attractive to potential foreign private investors and are also conducive to integrating Amari into the global market. The government is making a good-faith-effort to avoid playing favorites in the context of granting privileges to special interest groups. Military veterans and first responders, because of the risks inherent in their professions, do receive some special tax breaks and privileges, a benefit that is generally accepted by the population at large.

Currency Reserves

Amari’s currency reserves have generally increased in recent years, despite a tendency for month-to-month fluctuation. They reached a recent all-time high of $11,250 million, compared with a record low of $853 million 12 years ago. Legal tender is the Amari shilling (Ashs). The current exchange rate is 100 Ashs per $1.

Private Banking

Amari’s private banks, and related private establishments performing banking functions, include 45 major banks, 10 microfinance banks, 6 representative offices of foreign banks, 80 foreign exchange bureaus, 12 money remittance providers, and 2 credit reference bureaus. Government banking policies undergird sound banking practices by providing a country-wide framework, a codified set of ground rules, and stable environment conducive for operating private financial institutions.

Private Banks seeking official sanction in Amari must obtain approval from the Central Bank of Amari before they can begin operations. This became problematic three years ago, when the government imposed a moratorium on establishing new private banking institutions pending passage of the Commercial Banking Act. This act was the intended medium for implementing reforms to instill improved professional practices and greater record-keeping transparency into the overall national system. The situation improved significantly over the past year once the Amari Commercial Banking Act (ACBA) became law.